Did you know there are more ways to give to CASA?

Many people have assets that could benefit a nonprofit like CASA of McLennan County. Trying to understand and make plans to give in this way can feel overwhelming and complicated. The Waco Foundation has a program to benefit local nonprofits that makes this kind of giving easy.

Many people have assets that could benefit a nonprofit like CASA of McLennan County. Trying to understand and make plans to give in this way can feel overwhelming and complicated. The Waco Foundation has a program to benefit local nonprofits that makes this kind of giving easy.

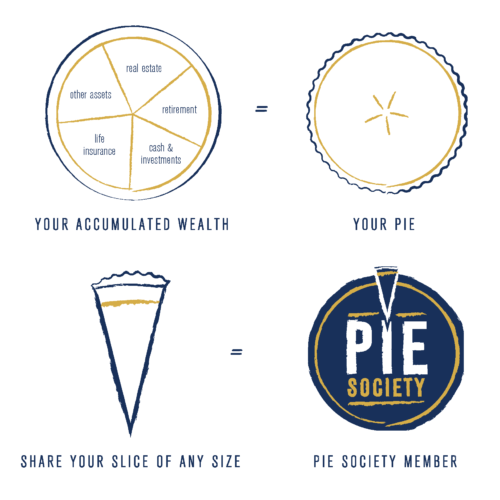

Waco Foundation’s Pie Society is a community-wide giving society made up of generous donors who have promised to leave a portion of their estate, or a piece of their pie, to charity. You can download a one-pager below about the Waco Foundation’s program to learn more and get started.

Learn More About The Pie Society

Did you know you can support CASA with your IRA and receive enhanced tax benefits for your contribution?

A Qualified Charitable Distribution (QCD) directly from your IRA to CASA can:

- Avoid taxes on transfers up to $100K ($200K if married)

- Reduce your taxable income, even if you do not itemize your deductions

- Make a gift that is not subject to the 50% AGI deduction limits on charitable gifts

- Satisfy some or all of your required minimum distribution (RMD) if over the age of 72

We encourage you to discuss your specific options with your investment advisor and tax professional. Ready to connect with CASA and support our advocacy with your IRA? Please email Anna Futral at afutral@casaforeverychild.org.